Black Community Page

|

|

|

|

COMMUNITY OVERVIEW

Exploring financial priorities within the Black community

Managing, reducing, and eliminating debt

Black Americans are generally more concerned than other racial groups about the impact of their financial choices on future generations and want to ensure that they don’t leave behind a debt burden for their families.1 So, although retirement savings may be a financial goal, Black Americans tend to focus on lowering their debt obligations—revolving credit card balances, student loans, and mortgages—and building an emergency fund.

What this means for employers:

When thinking about benefits and perks to attract and retain a diverse workforce, be aware that certain benefits—such as student debt repayment—have the potential to provide a more significant impact for Black, Latino/a,LGBTQ+, young, and female employees, while also being a high-value benefit across all groups.2

Building generational wealth

Beyond the desire to not leave behind a debt burden, Black Americans also want to build wealth for future generations of their families. More than half of Black survey respondents—ten percentage points more than non-Black respondents—said they want solutions that help build long-term wealth, including products for retirement planning (33% of respondents), financial planning (31%), and wealth management (26%).1

What this means for employers:

Proactively evaluate your plan design to ensure that it maximizes Black employee engagement by considering how it could help get them closer to meeting their short- and long-term goals.

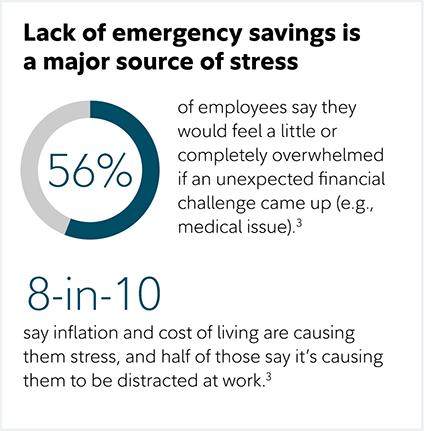

Overcoming obstacles to building an emergency fund

For most members of the Black community, a lack of emergency savings is a significant stressor.3

What this means for employers:

You have an opportunity to encourage financial engagement by ensuring an inclusive, well-communicated benefits package that addresses short- and long-term financial needs. Consider providing tools, resources, and financial solutions that help Black employees maximize their money.

BLACK HISTORY MONTH 2026 TOOLKIT AND BEYOND

Make the most of your money and create a financial legacy

Learn practical strategies, gain new perspectives, and discover resources to help you take your money to the next level.

Download and use the following materials to drive awareness and engagement with your workforce throughout Black History Month and beyond:

Black History Month Tools:

- Digital Sign (JPG)

- Digital Sign (PPT)

- Digital Poster (printable)

- Newsletter Blurb

- Employee Workshop Invitation (OFT)

- Employee Workshop Invitation (DOC)

Evergreen Tools

- Digital Sign (JPG)

- Digital Sign (PPT)

- Digital Poster (printable)

- Newsletter Blurb

- Employee Email (OFT)

- Employee Email (DOC)

HELPFUL RESOURCES

Thought Leadership

Use key insights from our research to align your benefits with the needs of your diverse workforce.

Is emergency savings the key to employee financial wellness?

Fidelity Workplace Consulting*

Fidelity can also work with employers to advance their diversity, equity, and inclusion efforts via Fidelity Workplace Consulting. *Please note that this is a fee-for-service option, which is available from Fidelity’s Workplace Consulting team.

BLACK COMMUNITY

Take your money to the next level

Find tips, tools, and resources that can help your employees save more, plan better, and create a financial legacy.

Fidelity.com/BlackLegacyFidelity retail products and services are offered beyond those of your employer-sponsored retirement plan.

References:

- McKinsey Institute for Black Economic Mobility, “Investing in—and-with—Black consumers in financial services.” September 2022.

- Fidelity Investments, “Inclusive Financial Wellness.” April 2023.

- Fidelity Investments, “Helping Employees Save for Emergencies.” October 2023.