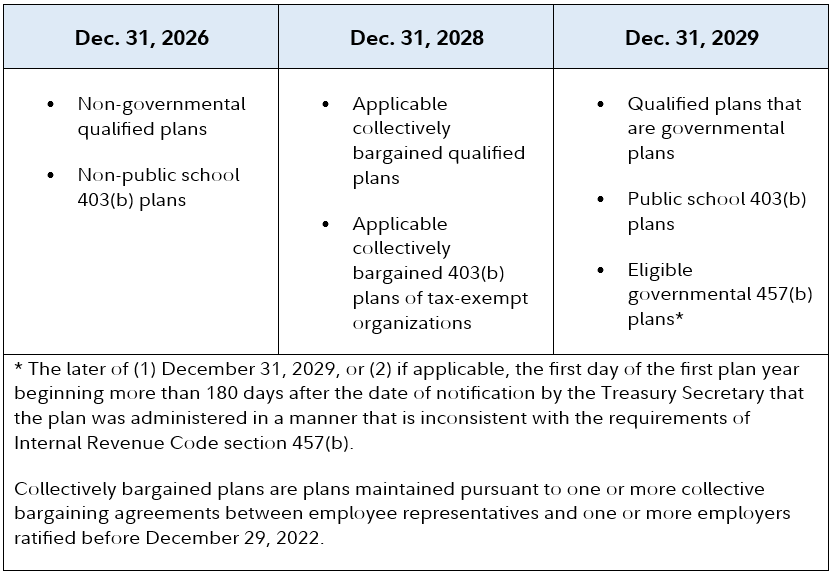

Plan Document Amendments:

Deadlines for the CARES Act, SECURE 1.0 and 2.0 Acts

As of March 2024

Fidelity will send a good faith amendment to plan sponsors using Fidelity’s Preapproved Plan Document before the deadline with applicable instructions. Fidelity will also provide content for plan sponsors to consider using to satisfy their Summary Plan Description–related disclosure obligations.