Guaranteed Income Direct – Employee Education Toolkit

The uncertainty of having enough to cover their bills in retirement may leave your employees concerned as they transition from saving to living.

A guaranteed income annuity might help by providing a steady flow of income to help cover any gaps in their essential expenses throughout their lifetime.

According to a recent study, people who have a guaranteed income annuity as part of their retirement income plan actually tend to feel more secure in retirement.1 And here’s why:

- No outliving their savings2

- Are protected from market swings

- Initial investment may not be taxed (monthly payments are taxed as income)3

Offering access to guaranteed income options in the plan is one way for you to help your employees successfully transition into retirement.

Toolkit Resources

The following resources are designed to help you educate and inform employees about the benefits of Guaranteed Income Direct in your plan. Before you get started, consider reviewing the Participant Experience Map for ideas on how to use these resources.

Email – Guaranteed Income Direct – for eligible participants

Educate retired and separated employees about guaranteed income and Guaranteed Income Direct.

Tell employees about new Guaranteed Income Direct benefit and each participant will be directed to the appropriate Guaranteed Income Direct experience (see screenshots above).

Video – Role of income annuities

Provide engaging education on annuities and how they could become part of their retirement income plan.

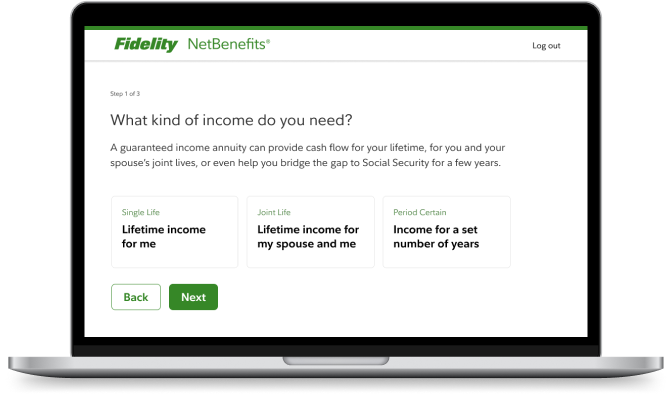

Video – Guaranteed Income Direct experience

Share the Guaranteed Income Direct experience on NetBenefits.

Brochure

Educate employees about retirement income planning, how income annuities can fill a gap, and their access to Guaranteed Income Direct.

Frequently Asked Questions (FAQ)

Provide answers to your participants’ most common questions about Guaranteed Income Direct.

One pager / Educational Workshop Slide

Share an overview of Guaranteed Income Direct with employees. Use this piece as a standalone or inserted into educational workshops offered by Fidelity.

Annuities 101

This 2-page document provides employees with basic education about annuities, including what they are, how they work, and how different types compare.

Newsletter / Blog post

Post about how your employees can benefit from guaranteed income in retirement.

Intranet/Internal Social Copy

“Coming soon” message that can help build employee awareness and engagement around this new plan benefit.

Postcard

Send guaranteed income information directly to your eligible employees.

Please note: Guaranteed Income Direct is only available for plans who have the solution offered in their plan.